Pay With Q Card

and Q Mastercard

Q Card or Q Mastercard is your perfect shopping partner to purchase your holidays, combining the benefits of a credit card with a range of interest-free deals.

We offer interest-free deals ranging from 6, 10, 12 & 18 months. Ask us about our current finance offers.

Minimum spend $500. Annual Account Fee of $50 applies. A $55 Establishment Fee for new Q Mastercard Cardholders and a $35 Advance Fee for existing Q Mastercard Cardholders will apply. Minimum payments of 3% of the monthly closing balance or $10 (whichever is greater) are required throughout interest free period. Paying only the minimum monthly payments will not fully repay the loan before the end of the interest free period. Q Mastercard Standard Interest Rate, currently 28.95% p.a. applies to any outstanding balance at end of a payment holiday or interest free period. Q Mastercard lending criteria, fees, terms and conditions apply. Rate and fees are correct as at date of publication, subject to change.

Payment Holiday and Interest Free Flexi Payment Plans:

No payments and no interest for 10 months (“Payment Holiday”) is available until 31 March 2026. Minimum spend $250. Annual Account Fee of $50 applies. A $55 Establishment Fee for new Q Mastercard Cardholders and a $35 Advance Fee for existing Q Mastercard Cardholders will apply. Q Mastercard Standard Interest Rate, currently 28.95% p.a. applies to any outstanding balance at end of a payment holiday or interest free period. Q Mastercard lending criteria, fees, terms and conditions apply. Rate and fees are correct as at date of publication, subject to change.

Pay with Gem Visa

and Gem CreditLine

Travel Better with Gem Visa and Gem CreditLine. Get 9 months no interest & no payments when you purchase travel over $500. We also offer interest free finance for 6, 10, 12 or 16 months interest free. Ask us about out current interest free finance offers.

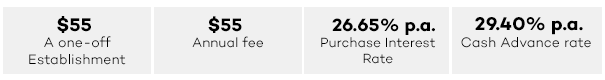

Minimum purchase $500. Credit and lending criteria and fees, including a Gem Visa $55 establishment fee and annual fees ($65 Gem Visa (charged $32.50 half yearly)/$65 Gem CreditLine (charged $32.50 half yearly)) apply. Prevailing interest rate (currently Gem Visa 29.49% p.a./Gem CreditLine 29.95% p.a.) applies to any remaining balance on the expiry of the interest free term. For cash advances, an interest rate of 29.95% p.a. and fees of ($2 Gem Visa/$6 Gem CreditLine) applies. Further information on rates and fees can be found at gemfinance.co.nz. Paying only the minimum monthly repayment of 3% of the outstanding monthly balance or $20 (whichever is more), will not be sufficient to repay the purchase amount(s) within the promotional period. Amount payable will be shown on your monthly statement. Available on participating Gem Visa or Gem CreditLine cards only. New customers must be approved for a Gem Visa credit card. Credit provided by Latitude Financial Services Limited.